Inflation may be down but there’s still real uncertainty for business owners. We’ve been trading in challenging times for a number of years now. Knowing what step to take next is a key worry, we know you invest more than simply time and money into your business. It is more than a job but part of your identity.

So, how do you get more clarity for your future plans? And how do you work on the short-term future of the business, when sales, income and cash may be in short supply?

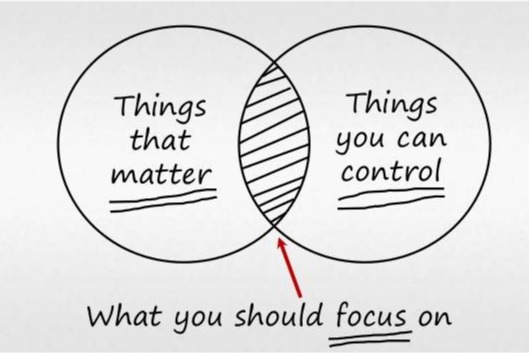

Focusing your efforts in the right places

As a business owner, you can always think of new business-critical issues – but the reality is that you CAN’T control all these elements. This sense of mounting uncertainty is likely to raise your stress levels and make you more anxious.

So, how do you overcome these worries and find a practical solution?

Try to focus on the things you can control:

- Identify the things that matter to the short, medium and long-term success of the business

- Find the things you can control and over which you have some influence.

It’s too overwhelming to try and work on everything at the same time. Instead, try to focus on one major thing you can achieve each day to improve business performance.

- Review your overheads and costs – one way to reduce your cashflow worries is to reduce your spending. Look at your controllable overheads and see if there are ways to negotiate better terms with suppliers, cut down on expenses or pause any subscriptions.

- Talk to debtors and creditors – if you can bring down your aged debt, that will help your overall financial health. Talk to any late-paying customers and agree when these debts will be paid. And talk to suppliers about extending payment terms, if possible.

- Consider alternative revenue streams – if your current business model isn’t working well, are there other services that you could diversify into? Any new revenue streams will help to bolster your income and cash position, working with partners could be a key way to grow your revenue.

- Update your website and marketing – having a great online presence is vital, is yours up to date with all the changes we’ve seen over the last 4 years?

- Encourage your team – maintaining motivation and nurturing team spirit is even more crucial in this more rapidly changing world. The more engaged your team is, the easier it will be to embrace change together.

Talk to us about other strategies for dealing with uncertainty in your business.

At the point of selling your business, getting a good price for the company will be a major goal. A key way to achieve this is to add value to the business as part of your ongoing exit strategy.

In this series, we’ll give you all the advice you need to plan your exit, add value to the business, negotiate a great deal and define your new pathway once the business is sold.

You’ve put blood, sweat and tears into this business. So, you’re going to want to achieve a sale price that reflects this hard work, giving you the funds to start the next phase in your journey.

Your potential buyer will be looking for a profitable, well-run business that can prove it’s a viable enterprise. To do this, it’s vital to look at core ways of improving the attractiveness of the company, gradually adding incremental value and allowing you to negotiate a good price.

Let’s take a look at some important ways to add value to the business:

Increase your profitability

A buyer wants an acquisition that will turn a profit. To boost the company’s profitability, look at improving your margins, reducing costs and increasing revenues. Ways to achieve this can include streamlining your operations, negotiating better deals with suppliers and increasing brand loyalty with your customers.

Strengthen your financial performance

It’s important to run a tight financial ship. Aim for the company to be in a positive cashflow position, reduce your ageing debt and strengthen the balance sheet to demonstrate financial stability. This will mean getting in control of your inventory and spending, being proactive about collecting outstanding receivables and exploring financing options, such as invoice finance or bank loans.

Nurture your customer relationships

Loyal customers spend more and provide a stable pipeline of sales and revenue. Building these strong customer relationships is a critical part of adding value, and can start by providing excellent customer service, offering loyalty programs and actively seeking (and acting on) customer feedback.

Invest in the company’s growth

A growing company is an attractive proposition to any buyer, so it’s important to continue investing in growth. Explore new products, services or markets to expand the business’s potential, add value and show the potential behind your business concept. The R&D, strategic planning and resourcing that’s involved will be an investment that pays off once you have an interested buyer.

Prepare for the due diligence process

Before a buyer makes an offer, they’ll want to carry out due diligence checks on the business. To be ready, you’ll need to get your financial records, contracts and other relevant documents in order, and make sure all the information is easy to find and access. Making these checks simple and straightforward helps potential buyers assess the business’s value and gain confidence in the company.

Talk to us about planning the sale of your business

Making your business more attractive to a potential buyer takes good planning, patience and a real focus on adding value. Starting this value-add process early is vital.

If you want to start adding value to the company, prior to selling up, come and talk to us. Our team can help you deliver an exit strategy that increases value and delivers a great deal.